Everything About FHA Loan Application (Requirements, Process and Approval Method)

With less stringent financial standards, Federal Housing Administration (FHA) loan is a sort of government-backed mortgage loan that can help you purchase a home. Having debt or a low credit score may make you eligible for Federal Housing Administration loan. Even with a bankruptcy or other financial issue in your past, you might be able to obtain an FHA loan. In this post, we’ll examine FHA mortgages in more detail, along with the qualifications needed and whether you qualify.

What Is An FHA Loan?

The Federal Housing Administration, a department of the Department of Housing and Urban Development, is responsible for backing FHA loans. The FHA insures FHA loans, so if you default on your loan, your lender is protected from loss by this institution.

There are low down payment possibilities and reduced minimum credit score requirements for FHA loans, but you must also pay mortgage insurance.

FHA loans can be particularly alluring for first-time home buyers due to the possibility of a low down payment and more relaxed credit standards, however, you don’t have to be a first-time home buyer in order to qualify.

Below Are Some Benefits of Federal Housing Administration loans:

• When compared to other loans, credit score requirements are less stringent.

• You can put down less money with your lender.

• Even if you’ve experienced bankruptcy or other financial problems in the past, you can still be eligible for an FHA loan.

• You can frequently roll your loan’s FHA closing expenses into it.

Federal Housing Administration Loan Requirements

For example, borrowers must satisfy the following standards in order to be eligible for an FHA loan:

• An appraiser approved by the FHA must evaluate the house you are considering.

• A new FHA loan can only be obtained for a home that will serve as your primary residence; therefore, it cannot be used to purchase an investment property or a second home.

• Within 60 days after the closing, you must move into the property.

• There needs to be an inspection, and the inspection results need to state whether the property complies with minimal property standards.

There are a few more requirements to meet, such as down payment requirements, mortgage insurance, credit standards, loan restrictions, and income requirements. Most of the time, DACA participants must meet the same FHA qualifications in order to obtain a mortgage. We’ll examine these aspects in more detail.

Federal Housing Administration Loan Down Payments

Your initial investment for a property is called down payment and represents a portion of the home’s buying price. Your credit score is a key factor in determining the minimal down payment you may make on an FHA loan. You may determine your creditworthiness by looking at your credit score, which ranges from 300 to 850.

For borrowers with credit scores of at least 580, an FHA loan requires a 3.5% minimum down payment. Your credit score could be between 500 and 579 if you’re able to put down 10%. A credit score of 580 or higher is needed to qualify for an FHA loan through Rocket Mortgage®. You may estimate your monthly mortgage payments and see how your down payment amount will change with the use of a mortgage calculator.

Federal Housing Administration Mortgage Insurance

A mortgage insurance premium (MIP) is required for an FHA loan. Mortgage insurance is placed in place to protect your FHA lender from losses if you don’t make your loan payments.

Unless you made a down payment of at least 10%, in which case MIP would be on the loan for 11 years, mortgage insurance is typically paid throughout the duration of an FHA loan. There are several alternative methods for calculating FHA loan mortgage insurance. First, a one-time mortgage surcharge is assessed, which is typically equal to 1.75 percent of your basic loan amount.

Additionally, FHA borrowers must pay a yearly mortgage insurance premium that is determined by the term (duration) of your loan, your loan-to-value (LTV) percentage, the total amount of your mortgage, and the amount of your down payment. MIP payments per year range from 0.45% to 1.05% of the original loan amount.

Federal Housing Administration Loans And Credit Score

Your credit score is determined by a variety of elements, such as:

• The kind of credit you possess (whether you have credit cards, loans, etc.)

• Credit usage, or just the amount of credit you use

• If you make your bill payments on time.

• How much debt you have from credit cards

• How much fresh credit you’ve obtained recently

A larger debt-to-income ratio, or DTI, may be acceptable to lenders if your credit score is higher. The debt-to-income ratio, or DTI, is the portion of your monthly gross income that is used to pay down debts. Your DTI is calculated by dividing your monthly gross income by the sum of all your debt payments (your monthly income before taxes). This amount is shown as a percentage.

Divide your debts—student loans, vehicle loans, etc.—by your gross monthly income to find your own DTI ratio. Your DTI, for instance, would be 25% if your debts, which include your student loans and auto loan, was $2,000 per month and your income was $8,000 per month.

You’ll be in better shape the lower your DTI is. If your DTI is higher, you might be able to get an FHA loan if your credit score is higher.

According to the FHA, if your loan is manually underwritten, your monthly mortgage payment should not exceed 31% of your monthly gross income. In addition, your debt-to-income ratio (DTI) shouldn’t, under certain conditions, exceed 43% of your monthly gross income. As mentioned above, if your credit score is higher, you could be able to qualify with a greater DTI.

Federal Housing Administration Loan Limits

For an FHA loan, there is a maximum amount you can borrow, and how much you can borrow depends on the county in which your prospective property is located.

The maximum FHA lending limit for high-cost areas (such major metropolitan areas) is $970,800 for 2022, according to the Department of Housing and Urban Development. For Alaska and Hawaii, Rocket Mortgage® has a similar cap. In terms of loan limits, lenders’ attitudes toward Alaska and Hawaii do differ. The FHA maximum can drop to $420,680 in less expensive areas. Counties’ property values are used to determine loan restrictions. The restrictions for single-family homes are as follows. Limits might be increased if you have more than one unit.

The FHA mortgage limits website allows you to search for the FHA mortgage limitations for a single or many locations. A value for each area’s median sale price may be seen on the page as well. The median price estimates used by HUD to determine loan limits are those.

Federal Housing Administration Interest Rates

When compared to conventional mortgages, FHA interest rates can be reasonable. This is so because having the support of the government makes you less risky and enables lenders to charge you a reduced interest rate in exchange. The rate is determined by a number of elements, including as the current interest rates, your income, credit score, the amount you intend to borrow, the size of your down payment, your DTI ratio, and more.

Federal Housing Administration Income Requirements

Your ability to obtain an FHA loan is not dependent on a certain level of income, but you must show a history of consistent employment. Share your pay stubs, W-2s, federal tax returns, and bank statements with your lender so they can verify your income. Other forms of documentation may also be required by your lender.

Types Of Federal Housing Administration Home Loans

FHA loans are available in a number of different forms. Your options for an FHA loan have an impact on the kind of house you can buy and how you can use the funds you get. Due to this, it is extremely important to ensure you obtain the appropriate kind of loan. You might want to take another sort of government loan into consideration if none of the following loan types fit your objectives.

Let’s examine a couple distinct FHA loan categories.

Purchase

If you have a median FICO® Score of 580, you may be able to buy a home with as little as 3.5% down. It’s important to remember that if your score is that low, you must maintain a DTI that is also very low. Before your mortgage payment is taken into account, Rocket Mortgage demands a ratio of no more than 38%, and no more than 45% once it has been taken into account.

If your median FICO® score is 620 or above, you might be eligible for a larger DTI. Your DTI will never be able to exceed 57%.

With an FHA loan from Rocket Mortgage, you can buy up to a two-unit home.

Federal Housing Administration Rate/Term Refinances

You might consider looking into an FHA rate/term refinance if you find yourself in a scenario where you have another type of mortgage and want to benefit from lower rates but your credit has suffered.

Due to its laxer credit standards, this can be a viable choice. If your DTI is low and your FICO® Score median is as low as 580, you can utilize this to modify your term or lower your rate. If your median FICO® score is 620 or above, you could be permitted to bring additional debt into the deal.

It’s important to keep in mind that, depending on the amount of equity you bring into the rate/term refinance, you might have to pay mortgage insurance premiums for the duration of the loan (or at least 11 years with 10% equity or more), in addition to an upfront fee. You can save money on your rate/term transaction if you currently have an FHA loan. Next, let’s talk about it!

Federal Housing Administration Streamline

Existing FHA borrowers can perform a rate/term refinance using an FHA Streamline, which comes with a few unique advantages. Initially, even if you owe more on your house than it is worth, you might be able to refinance into a lower rate.

The rationale behind this is that the FHA benefits from your ability to stay in your house and finish paying off your loan if your payment is more manageable. The MIP for FHA Streamlines is 0.55% of your total loan amount per year, so you’ll typically be able to acquire a reduced mortgage insurance rate. Furthermore, the upfront MIP is incredibly low—just 0.01%.

Reduced documentation is an additional advantage of FHA Streamlines. Considering that you already have an FHA loan, you can be eligible for less documentation in each of the following categories:

• Less stringent assessment requirements

• A scanty verification of employment

• Less evidence of income and assets

Additionally, there are certain other considerations. Rocket Mortgage requires a 640 median FICO® Score if you don’t already have a mortgage with us. The necessary median FICO® score is 580 if your loan is with us. Timing is additionally crucial. Before you can conduct a streamline, you must have made at least six payments on your current loan. A minimum of 210 days must also elapse between the first payment you make on your present loan and lastly, your debt must be paid up in full. Having no 30-day past-due payments in the previous six months and just one 30-day past-due payment in the previous year qualifies you for an FHA Streamline.

Cash-Out Refinance

With an FHA loan, you are able to refinance for cash if you so want. In order to qualify, Rocket Mortgage needs a credit score with a median of at least 620. The FHA does stipulate that you must retain at least 15% of your home’s equity if you sell it for cash.

Complete documentation is necessary if you’re refinancing with cash out. Along with employment verification, this also entails pooling assets and income.

Federal Housing Administration 203(k) Loan

Rocket Mortgage does not provide this specific loan, but an FHA 203(k) loan enables you to purchase a home and make modifications with only one loan. A 203(k) loan can be used only for renovations, however this is typically not the most cost-effective option. You cannot borrow less than the $5,000 minimum balance for an FHA 203(k) loan. To comply with your loan terms, any home repairs or renovations you make must be finished within six months.

With a 203(k) loan, you might finish the following projects:

• Replacing deteriorated or hazardous flooring

• Improving the home’s “modernization,” which may entail installing apparatus like central air conditioning or an automatic garage door opener.

• Removing or installing new roofs, gutters, or plumbing.

• Improving accessibility for disabled residents of the house

• Making foundational alterations and repairs to the house’s structure

Standard loans and Limited loans are the two types of 203(k) loans available. Standard loans provide you greater flexibility to fix up your house, while Limited loans demand less paperwork for approval.

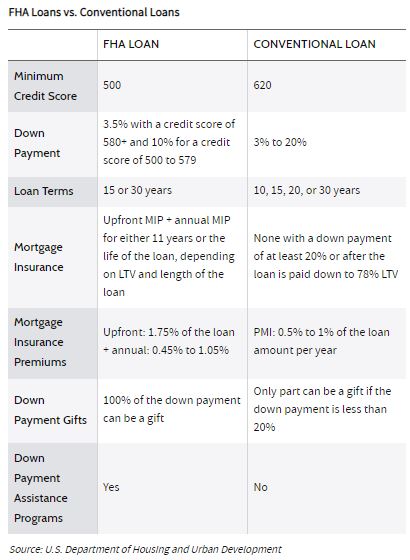

Federal Housing Administration Vs. Conventional Loans

A typical substitute for an FHA loan is a conventional loan. Borrowers frequently think about switching from an FHA loan to a conventional loan even though conventional mortgages have higher financial requirements. These loans also frequently have cheaper interest rates and mortgage insurance that is removed at 20% equity. Here are some of the key distinctions between conventional and FHA loans.

Would You Be A Good Choice For A Federal Housing Administration Loan?

If you’re still contemplating the benefits and drawbacks of an FHA loan in comparison to a conventional loan, you should be aware that the latter is not backed by the government. Fannie Mae and Freddie Mac, two government-sponsored companies that give mortgage funding to lenders, are the sources of conventional loans.

Keep in mind that you’ll need a higher credit score and a lower DTI to qualify as they have more strict restrictions. FHA loans, on the other hand, are nonconforming loans, which means they don’t meet the criteria set forth by Freddie Mac or Fannie Mae for a purchase loan.

Regardless of whether you select a conventional or FHA loan, there are a few additional expenses that you should be aware of. Closing expenses, or the fees connected with processing and securing your loan, are something you’ll have to pay. Depending on the mortgage’s terms and the cost of the home, these can change, but you should plan to set aside between 3% and 6% of the property’s value.

Additionally, you should set aside 1% to 3% of your purchase price for maintenance. The age of the house will have an impact on the exact percentage. Less likely are items to break immediately if your home is newer. You might need to set aside more money if the house is older. Finally, if you live in a community with homeowners association dues, you will have to pay them either monthly or annually.